Fixed deposits is one of the easiest choices that would come to anyone’s mind when opting for investments. This is mainly because it is the most traditional methods of all that we are aware of. However, there is another investment option that you must have heard of- Mutual Funds.

Well, this is the intent for writing this blog- making all of you make an informed investment decision by enlightening you with the features of both the options.

Let us start from the basics:

What are Fixed deposits (FD)?

A fixed deposit account is an investment account under which our money is deposited with a bank for a definite time period and a fixed rate of interest is paid periodically until the maturity period comes to an end.

What are Mutual funds?

In simpler terms, it is a fund managed by technically sound experts or professionals who collect money from investors and put that money in wide range of securities. These securities can range from shares and debentures to money market instruments depending upon the objectives of the scheme.

The income earned through these investments and capital appreciation realized by the schemes are shared by its unit holders in the proportion of the units held by them.

Anybody with an investible surplus of as little as a few thousand rupees can invest in mutual funds by buying units of a particular mutual fund scheme that has a defined investment objective and strategy.

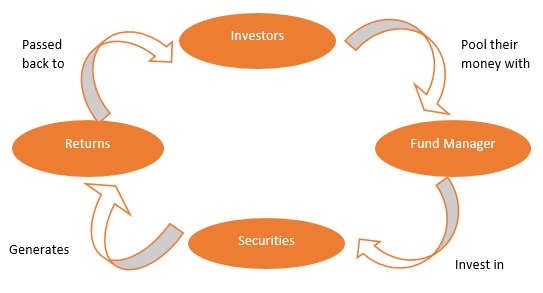

This is how a mutual fund briefly works:

Now, let us understand both the options by going through each comparison parameter:

-

Rate of return:

Rate of return is the income you earn in the form of interest, dividends or other gains such as capital gains, etc.

Fixed Deposits: In case of fixed deposits, the return is in the form of periodic fixed interest which is decided at the time of investment. There is no uncertainty in the rate of return and would remain fixed throughout the maturity period.

Mutual funds: Return is in the form of interest, dividend and capital gains and it depends on the market movement as these are market linked returns. There is no guarantee of returns as all mutual funds cannot be winners. There may be some schemes which may not perform upto the mark. However, over a medium to long term investment, investors usually get higher returns.

Thus, mutual funds usually outscore fixed deposits in positive market conditions while the case is vice versa in case of negative market conditions.

-

Risk:

Risk in simple terms is the exposure to losses.

Fixed Deposits: Fixed deposits are considered to be low risk financial instruments as you earn a fixed rate of interest irrespective of the outside market conditions.

MF: While in case of mutual funds, the risk varies from medium to high as this is related to market. So higher the volatility of the market, higher your risk factor. However, mutual funds are highly regulated as all mutual funds are registered with SEBI and are strictly regulated with strict mutual fund regulations so your money is protected.

Thus your investing decision would entirely depend on your risk appetite, i.e. how much risk are you willing to take.

If you have a low risk appetite, Fixed deposit is the ideal investment option. However, if you have a medium to high risk appetite, mutual funds are the way to go.

-

Tax status:

Fixed Deposits: interest earned on FDs is taxable as per the slab rate you fall in.

For example,

If you have deposited INR 500,000 as FD on which you will be earning an interest rate of 8% i.e. 40,000. However, if you are following in the tax bracket of 30%, you would be effectively earning only INR 28,000 (40,000*70%).

Thus you can see how important it is to consider the taxation aspects while making such investment decisions as the rate of return may seem very attractive on paper but after considering the post-tax return, you would find that the effective return might be less.

Get more detail about fixed deposit Interest rate

Mutual funds: Depending on whether you have invested in equity based mutual fund schemes or debt based mutual fund schemes, your income would be taxable.

- Dividend earned from mutual funds is entirely exempt, i.e. it is completely tax free.

- Interest from mutual funds is however taxable as per your slab rate.

- Capital gains from:

- Equity based mutual funds: Long term capital gains is entirely tax free under section 10 (38), while short term capital gains are taxable at a lower rate of 15%.

- Other mutual funds: Long term capital gains are taxable at the rate of 20% and short term capital gains are taxable as per the slab rate you fall into, which can be 10%, 20% or even 30%.

Thus if you are investing into mutual funds, it is advisable to invest into equity based schemes. Even if you are investing into other mutual funds, it would be advisable to hold it for more than 36 months to avail the benefit of lower tax rates of 20%.

-

Premature withdrawal:

This means withdrawing the money before the definite period expires

Fixed Deposits: This is possible after payment of premature withdrawal fees.

Mutual funds: In case of mutual funds, liquidity is higher and you can exit easily by paying an amount known as exit load. Exit load condition vary according to the schemes you enter into. Thus, it is important to read the terms and conditions while signing the agreement.

Get More Detail About Mutual Funds

I have compared both the options in a summarized manner below:

| Fixed deposits | Basis of comparison | Mutual funds |

| Assured returns | Rate of returns | It depends on the underlying asset |

| Low risk | Risk | Medium to high risk |

| Possible with premature withdrawal fees | Premature withdrawal | Possible with an exit load |

| Deduction under section 80C for specified fixed deposits at the time of investment | Tax benefits | Various tax benefits in the form of exemptions and lower tax rates |

Thus, it is advisable that while you invest you consider the following factors:

- Expected return alongwith tax aspects

- Risk appetite

- Tax status

- Other factors such as guarantee of returns, initial cost, etc

However, it is recommended that while deciding to invest into mutual funds you should definitely consult with a tax expert or an investment consultant who can guide with all the market related factors and the possibility of returns.