An Education loan Story – Taraqi ki EMI

This is the loan story of Nishu Saini, a confident girl who is currently pursuing her MBA from the premier institute of Dept of Management Studies, IIT Roorkee. She has taken an education loan to fulfill her dreams and become a successful business professional.

She has been a brilliant student throughout her childhood scoring more than 90 percent in her senior and higher secondary. For pursuing undergraduate degree in Engineering, she had to take an education loan of about 3.5 lacs. (Her college fee was approximately Rs. 90,000 p.a.) The loan came with an interest rate of 13.5%. Since the institute was not a premiere institute, the interest rate on loan was higher. She performed exceptionally well in her Engineering as well scoring an aggregate percentage of 85%. In the end it all was worth it, when she got placed in an IT company and on top of that she was also able to crack CAT and convert some top b-schools one of them being DoMS, IIT Roorkee.

However, MBA Education is not cheap and with the existing burden of pending loan; the decision of taking another loan would have not been easy. She could have selected to work, earn nearly 3 lacs annually and repay the loan. The option she took (though sounds riskier but actually is way more rewarding in this case) was to get the pending loan extended, take a fresh loan and do MBA from a top institute like DoMS, IIT Roorkee.

Let’s consider the factors that led to her taking this decision.

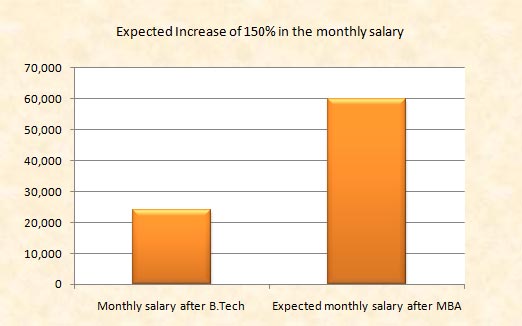

The opportunities you get to perform and excel at a premier B-school are unbeatable. The average placement offer at DOMS, IIT Roorkee is nearly 2.5 times of the amount she would be getting otherwise. Therefore, her salary is set to see an increase of 150%. Secondly, the loan she took this time of about 5 lacs comes at a better interest rate of 10.10 as IIT Roorkee is a Grade- A University.

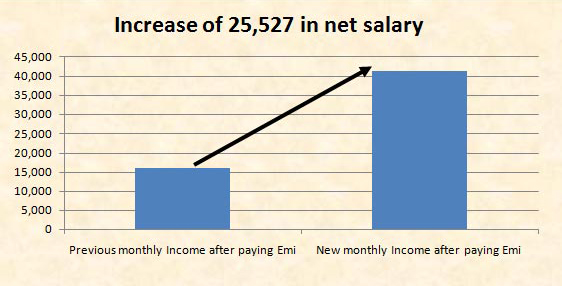

Her EMI for the old loan paid during the tenure of 5 years would have Rs. 8,072 whereas; the EMI for the total amount now (Extended+New) would be 18,545 for the same tenure. This increase in Emi can now easily be compensated because of increase in salary.

| Previous monthly Income after paying Emi | Rs. 15,928 |

| New monthly Income after paying Emi | Rs. 41,455 |

Therefore, the net monthly salary will tend to increase by Rs. 25,527 because of the new loan.

This will result in a total benefit worth more than 15 lacs during the loan tenure.

There is no element of surprise in the fact that Nishu is currently doing very well in her MBA as well. She is currently doing a summer internship with the Reserve Bank of India and has a bright future ahead. The loan she took is giving her wings to fly out towards her ambition.

We have enough points to back the fact that Nishu’s loans will have a Tarraqi ki EMI as she is building an asset for her future and wish her all the best in her pursuits…