How to improve your CIBIL score. Fast & Easiest Way

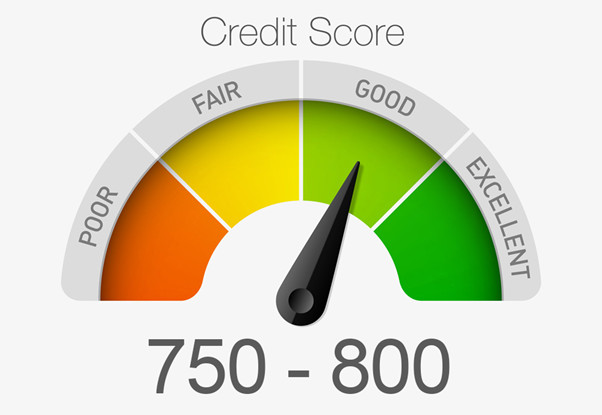

Your CIBIL score is a number between 300 and 900 that lenders use to assess your creditworthiness. A higher score means that you are a lower risk borrower, and you will be more likely to get approved for loans and credit cards with lower interest rates.

Here are some tips on how to improve your CIBIL score immediately:

- Pay your bills on time. This is the most important factor that affects your CIBIL score. Make sure to pay all of your bills on time, including your credit card bills, loan EMIs, and utility bills.

- Keep your credit utilization low. Your credit utilization ratio is the amount of credit you are using divided by the total amount of credit you have available. A high credit utilization ratio can lower your CIBIL score. Aim to keep your credit utilization ratio below 30%.

- Request a higher credit limit. If you have a low credit limit, your credit utilization ratio will be higher even if you are paying your bills on time. Requesting a higher credit limit can help to lower your credit utilization ratio and improve your CIBIL score.

- Dispute any errors on your credit report. If you see any errors on your credit report, dispute them immediately. Errors on your credit report can lower your CIBIL score.

- Consider getting a secured credit card. A secured credit card is a type of credit card that requires you to deposit a security deposit. This can help you to build your credit history if you have no credit history or a poor credit history.

It is important to note that you cannot improve your CIBIL score overnight. It takes time and effort to build a good credit history. However, by following these tips, you can improve your CIBIL score immediately and start enjoying the benefits of a good credit score.

Here are some additional tips that you can follow to improve your CIBIL score over time:

- Apply for credit only when you need it. Don’t apply for credit just for the sake of building your credit history. Only apply for credit when you actually need it.

- Keep your credit accounts open for as long as possible. Closing your credit accounts can lower your credit history and your CIBIL score.

- Vary your types of credit. Having a mix of different types of credit, such as credit cards, loans, and mortgages, can help to improve your CIBIL score.

By following these tips, you can improve your CIBIL score and start enjoying the benefits of a good credit score.